Note: Added Powder River Basin well on June 10, 2013

I don’t usually talk about “largest wells” in formations or plays because they aren’t representative of the productivity or economics of a play as a whole. With that said, it’s still good to know where the biggest wells are being drilled because that usually indicates there’s a lot of oil in the area (whether it can be extracted consistently and economically is another matter).

Note: Peak month rate oil/gas is the amount produced in a given month divided by 30 days.

Well Name: Behr 11-34

Operator: Whiting (WLL)

County, State: Mountrail, ND

Formation: Bakken

Spud Date: April 15, 2008

Peak Month Rate Oil: 1,492 BOPD

Peak Month Rate Gas: 1,008 Mcfpd

Cumulative Oil: 911,627 BO

Cumulative Gas: 558,996 Mcf

Latest Monthly Rate Oil: 273 BOPD

Latest Monthly Rate Gas: 242 Mcfpd

Source: North Dakota Oil & Gas Commission/The Energy Harbinger.

Well Name: Jendrusch Unit 1H

Operator: Plains Exploration and Production (PXP)

County, State: Karnes, TX

Formation: Eagle Ford

Spud Date: April 21, 2012

Peak Month Rate Oil: 2,551 BOPD

Peak Month Rate Gas: 3,917 Mcfpd

Cumulative Oil: 341,352 BO

Cumulative Gas: 629,981 Mcf

Latest Monthly Rate Oil: 681 BOPD

Latest Monthly Rate Gas: 1,825 Mcfpd

Source: Texas Railroad Commission/The Energy Harbinger.

Well Name: Frye Ranch 2012H

Operator: Forest Oil (FST)

County, State: Wheeler, TX

Formation: Granite Wash/Hogshooter

Spud Date: March 23, 2010

Peak Month Rate Oil: 2,149 BOPD

Peak Month Rate Gas: 20,630 Mcfpd

Cumulative Oil: 327,782 BO

Cumulative Gas: 6,081,260 Mcf

Latest Monthly Rate Oil: 70 BOPD

Latest Monthly Rate Gas: 1,444 Mcfpd

Source: Texas Railroad Commission/The Energy Harbinger.

Well Name: Livestock 1-25H

Operator: SandRidge Energy (SD)

County, State: Grant, OK

Formation: Mississippian Lime

Spud Date: March 18, 2012

Peak Month Rate Oil: 1,595 BOPD

Peak Month Rate Gas: 3,909 Mcfpd*

Cumulative Oil: 170,398 BO

Cumulative Gas: NA

Latest Monthly Rate Oil: 214 BOPD

Latest Monthly Rate Gas: NA

Source: Oklahoma County Commission/The Energy Harbinger.

*Natural gas data is not publicly available for this well. Rate was computed using IP rates in the completion report.

Well Name: Dolph 27-1HZX

Operator: Anadarko Petroleum (APC)

County, State: Weld, CO

Formation: Niobrara

Spud Date: January 9, 2011

Peak Month Rate Oil: 730 BOPD

Peak Month Rate Gas: 1,595 Mcfpd

Cumulative Oil: 154,287 BO

Cumulative Gas: 568,554 Mcf

Latest Monthly Rate Oil: 71 BOPD

Latest Monthly Rate Gas: 331 Mcfpd

Source: Colorado Oil and Gas Commission/The Energy Harbinger.

Well Name: Anderson 18H-1

Operator: Encana (ECA)

County, State: Amite, MS

Formation: Tuscaloosa Marine Shale

Spud Date: January 15, 2012

Peak Month Rate Oil: 840 BOPD

Peak Month Rate Gas: 267 Mcfpd

Cumulative Oil: 115,991 BO

Cumulative Gas: 35,075 Mcf

Latest Monthly Rate Oil: 169 BOPD

Latest Monthly Rate Gas: 54 Mcfpd

Source: Mississippi Oil & Gas Board/The Energy Harbinger.

Well Name: Federal 16-10/3FH

Operator: Helis (Private)

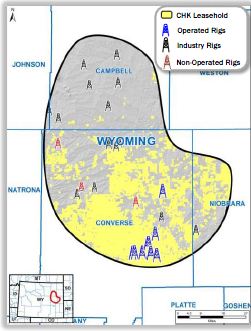

County, State: Converse, WY

Formation: Frontier

Spud Date: July 16, 2011

Peak Month Rate Oil: 1,198 BOPD

Peak Month Rate Gas: 1,461 Mcfpd

Cumulative Oil: 270,530 BO

Cumulative Gas: 272,705 Mcf

Latest Monthly Rate Oil: 281 BOPD

Latest Monthly Rate Gas: 258 Mcfpd

Source: Wyoming Oil and Gas Conservation Commission/The Energy Harbinger.

For those of you who use the prototype version of the The Well Map, this is the type of data you’ll be able to access using the full version which will launch this summer.

Disclaimer: These are the largest wells in the above formation that I’m aware of. If you know of larger ones, feel free to disclose.