A couple months ago I wrote a piece on the biggest wells by formation and I just came across one that should have been in that group. Chesapeake’s (CHK) Thurman Horn SL #406H well, located in Wheeler County, TX, produced at a whopping 6,829 BOEPD during its peak production month. While you might be inclined to think natural gas accounted for much of the production given the area, CHK broke out the hydrocarbon production for the first 8-days as follows, 74% oil, 16% natural gas liquids (NGLs) and 10% natural gas.

Well Name: Thurman Horn SL #406H

Operator: Chesapeake

County, State: Wheeler, TX

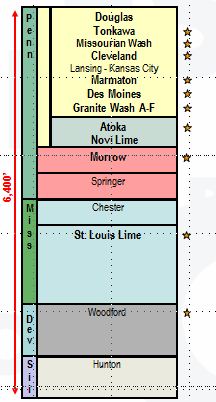

Formation: Upper Hogshooter/Missourian Wash (9,915′)

Spud Date: May 1, 2012

Peak Month Rate Oil: 4,801 BOPD

Peak Month Rate Gas: 12,172 Mcfpd

Cumulative Oil: 497,635 BO

Cumulative Gas: 2,112,139 Mcf

Latest Monthly Rate Oil: 249 BOPD

Latest Monthly Rate Gas: 2,395 Mcfpd

Source: Texas Railroad Commission/The Energy Harbinger.

While this is a monster well and might even be responsible for the largest 30-day rate of any horizontal well ever drilled on land, there’s a few things that need to be kept in mind. First, this well is not indicative of other wells drilled in the Texas Panhandle Wash play. Most of the wells drilled in this area are much gassier and produce far less oil. In fact, even as prolific as the oil production has been in this Thurman well, it only accounted for 30% of production during its last monthly rate (compared to 70% during its peak month) which shows us that the oil decline in these wells is very high.

What this well does show us is how prolific the Hogshooter (Missourian Wash) formation can be. CHK and Forest Oil (FST) have both drilled a number of Hogshooter wells that have produced impressive amounts of hydrocarbons. If you aren’t familiar with this zone, a comparison could probably be made to the Lodgepole in North Dakota: A prolific zone in a formation that only exists in certain areas and is very difficult to target. Chesapeake itself has approximately 30k net acres it considers prospective for the Hogshooter zone.