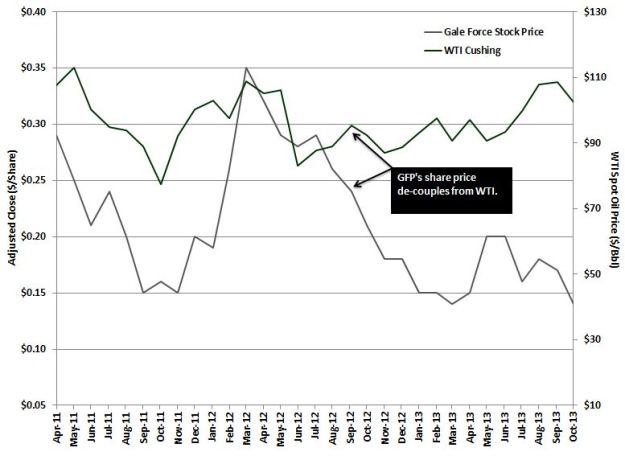

Last week, Texas oil producer Gale Force Petroleum (GFP) received its second letter this year from one of its top shareholders, New York based Iroquois Capital Opportunity Fund (ICO Fund). The letter was ICO Fund’s second request for GFP to shake-up its Board of Directors who, according to ICO, have caused “severe mismanagement of Gale Force’s otherwise valuable assets.” GFP’s share price, which closed at $0.14 on October 1, has been in a tail-spin since peaking at $0.38 in March 2012. The 63% price slide (see graph below) reflects decreased production due to poor well results and a lack of overall direction for the company.

If you’re not familiar with Gale Force, their assets include its Texas Reef prospect which consists of 4,300 acres in Anderson and Henderson Counties in East Texas, 4,101 acres in Wood County (East Texas) and 795 acres in Bee County (South Texas). They also own 10,000 non-operated acres in the Marcellus which serves as a nice cash flow piece. The Texas Reef asset was acquired in April 2012 for $4.6MM and is considered the company’s primary asset. To help finance the purchase and development of Texas Reef, GFP sold its interest in certain Oklahoma properties for $6.5MM in March, 2013. These assets produced at an average rate of approximately 121 BOEPD (40% oil) at the time of the sale.

Predictably, the sale of the Oklahoma properties caused the company’s average production to decline to160 BOEPD during the quarter ended June 30, 2013, 42% lower than the 277 BOEPD the company averaged during the same quarter in 2012. This production decline was expected to be offset by production increases from the Texas Reef play and its other assets which GFP predicted would “triple production year-over-year in 2012.” Unfortunately, completion mistakes caused its first two Texas Reef wells to produce from a water zone.

These results combined with significant hedging losses have left the company with $5.5MM in debt due in July, 2014, $706M in cash on its balance sheet and trailing 9-months operating cash flow of -$1.3MM. To make matters worse, one of its primary shareholders, Iroquois Capital, doesn’t believe management is capable of turning the ship around.

Gale Force’s Stock Price (April 2011 – October 2013)

Source: Yahoo Finance / The Energy Harbinger.

If Iroquois’ assertion that Gale Force’s stock price slide has more to do with “lack of effective oversight by the board,” than resource quality, the graph above shows that the market might agree. From April, 2011 to June, 2012, the oil weighted company’s stock tracked WTI before decoupling in the latter half of 2012. When an oil company decouples from WTI to this degree, either the asset base has deteriorated or the company is experiencing financial/operational troubles.

It would be difficult to argue the former as GFP’s asset base has certainly gotten oilier after the divestiture of the Gregg and Rusk County assets in Oklahoma. Production from these assets was approximately 40% natural gas and its sale raised $6.5MM which was used to pay down debt. Now the company is sitting on 2 million barrels of oil equivalent (MMBOE) (68% oil) in East Texas and the market is valuing the assets at $9.76 per barrel. This valuation is low when one considers the assets are in an established oil field and only 24% of the reserve basis is producing.

Just how undervalued is GFP?

Source: Financial Statements / The Energy Harbinger.

If we look at a micro-cap peer group made up of companies with conventional assets in mature basins, we get an average EV/Reserves multiple of $13.86, meaning on average companies with assets similar to Gale Force’s are valued approximately 44% higher. If we use the peer set multiple on GFP’s reserves of 2.1MMBOE, we receive an implied enterprise value of $29.26MM. If we then subtract net debt/preferred stock we receive an equity value of $18.64MM which we divide by the company’s 65MM shares outstanding to get an implied price per share of $0.29.

The company is undervalued, despite having valuable assets, because it has no financial plan to develop the assets. This is where a company with ICO Fund’s track record can step in and restore confidence to GFP’s shareholders. The company has several other micro-cap oil and gas companies in its portfolio, including AusTex (AOK) and PetroRiver (PTRC), proving that it has ample experience in the industry.

In addition, ICO Fund was instrumental in turning around Long Range Acoustic Device (LRAD) by replacing several board members and renegotiating options held by executives with very favorable strike prices. LRAD’s stock price is now up 51% since May, a tribute to Iroquois’ ability to put the correct people in place on the board and re-incentivize management. If Iroquois is able to reach a similar agreement with Gale Force, I believe it would restore confidence and value to a company that’s in obvious need of direction.

If your plan is to buy low on GFP, you might want to expedite that plan as the record date for its general meeting is October 9. The actual meeting is on November 21, so if you want to support Iroquois, who hired Kingsdale as its proxy, act fast.