General Information

Why I should care: It’s a new horizontal play with some interesting production results.

Geographical location: Northwest New Mexico.

Producing formations: Gallup, Mancos.

Main operators: Encana (ECA), WPX Energy (WPX).

Leasehold: ECA (176k net), WPX (31k net).

Average well cost: $4.5MM.

Average Royalty: 18%.

Average Peak Month Production by Formation

Gallup (27 wells): 275 BOPD and 406 Mcfpd (81% Oil).

Mancos (9 wells): 194 BOPD and 265 Mcfpd (71% Oil).

Source: www.thewellmap.com / New Mexico Oil Conservation Division.

Average Peak Month Production by Operator

ECA (27 wells): 215 BOPD and 409 Mcfpd (74% Oil).

WPX (6 wells): 391 BOPD and 318 Mcfpd (87% Oil).

Source: www.thewellmap.com / New Mexico Oil Conservation Division.

Average Peak Month Production by County

Rio Arriba (3 wells): 173 BOPD and 332 Mcfpd (56% Oil).

Sandoval (14 wells): 354 BOPD and 545 Mcfpd (79% Oil).

San Juan (16 wells): 175 BOPD and 271 Mcfpd (79% Oil).

Source: www.thewellmap.com / New Mexico Oil Conservation Division.

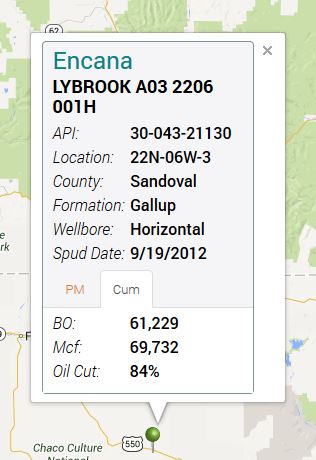

Largest Well by Cumulative Production

Source: www.thewellmap.com.

Smallest Well by Cumulative Production

Source: www.thewellmap.com.

Economics

Assuming $90 oil, $3.50 gas, 80% NRI and $4.5 well cost, a company needs to recover approximately 60 MBO (thousand barrels of oil) and 65 MMcf (million cubic feet of natural gas) to break even. Of the 10 wells that have been producing in the play for two years or longer, 3 have broken even. These three wells had peak production rates ranging from 275 BOPD and 718 Mcfpd to 535 BOPD and 854 Mcfpd. These ranges give us some parameters which will alow us to judge the ecoomics of new wells coming on.

The average peak month rates for wells spudded in 2013 are 329 BOPD and 400 Mcfpd, numbers that are similar to our early wells that have broken even. While it’s very early in this play, I think there’s reason to believe the average San Juan Basin well will pay back in two to three years which makes it competitive with current major plays from an economics standpoint. Will it be as big? Highly doubtful, but it could provide a nice production/earnings bump for the play’s early entrants.