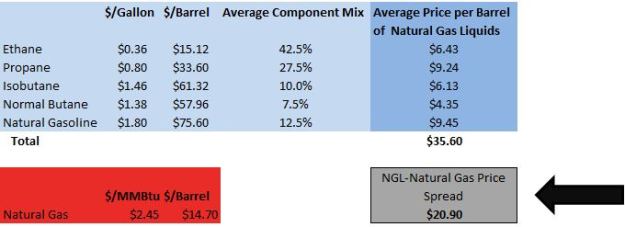

At market close on June 19, 2012 oil sold at the Cushing, Texas hub (WTI) fetched a price of $83.99 per barrel, whereas natural gas sold at $2.59 per Mcf at Henry Hub in Erath, Louisiana. On an energy equivalent basis, Six Mcf produces approximately the same amount of energy as one barrel of oil; therefore, all things equal (particularly with respect to supply in demand) we should expect $2.59 * 6 or $15.54 to equal the price of one barrel of oil. Instead, we find that one barrel of oil prices at a 5.4x premium to six mcf of natural gas. The premium paid for oil is caused by increased demand for the hydrocarbon from the developing world (China, India, etc) and its diminishing supply. Consequentially, natural gas has become an attractive energy source, not only for its pricing advantage to oil but also because it burns cleaner:

Average Emission Rates in the United States

Natural Gas Emissions

Carbon Dioxide: 1,135 lbs/MWh

Sulfur Dioxide: 0.1 lbs/MWh

Nitrogen Oxide: 1.7 lbs/MWh

Oil Emissions

Carbon Dioxide: 1,672 lbs/MWh

Sulfur Dioxide: 12.0 lbs/MWh

Nitrogen Oxide: 4.0 lbs/MWh

Source: www.epa.gov

Note regarding natural gas vehicle emissions: According to the DOE, transit buses with natural gas engines produced 49% lower nitrogen oxide emissions and 84% lower particulate matter emissions.

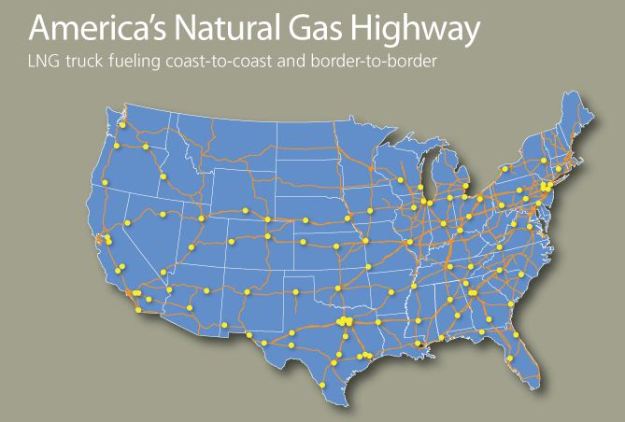

Are we taking advantage of cheap natural gas prices? Aside from coal-to-natural gas switching by U.S. utilities, companies have been building natural gas fueling stations for cars and trucks and converting gasoline engines to natural gas engines. Chesapeak Energy sponsored Clean Energy Fuels (NASDAQ: CLNE), a company who has T. Boone Pickens on its board, is currently working on a “natural gas highway” across the United States (see below). The company sells compressed natural gas (CNG) to passenger vehicles and fleets and liquefied natural gas (LNG) to the trucking industry. Per gallon prices (diesel gallon equivalent) for CNG and LNG at CLNE fueling stations averaged $2.28 and $2.88, respectively, during the week of June 18, 2012.

CLNE’s LNG Highway

Source: http://www.cleanenergyfuels.com

For information regarding CNG fueling stations in the U.S., click here.

Companies like CLNE, Westport Innovations (NASDAQ: WPRT / TSX: WPT) and World CNG (private) are currently focused on building infrastructure for natural gas vehicles (NGVs) and either converting cars/trucks to CNG/LNG or building new NGVs. Their clients are primarily trucking companies and or vehicle fleets such as airport shuttles, delivery trucks, garbage trucks and taxis. Given the relatively limited number of natural gas fueling stations, this makes sense because its easier for trucks and shuttles who have defined routes to operate on fueling schedules, versus passenger cars whose destinations change sporadically. I would expect that as the infrastructure for fueling stations continues to be built out, it will make more sense for greater numbers of passenger vehicles to convert to natural gas.

CLNE has built more than 150 fueling stations and has capacity to fuel more than 25,000 vehicles per day. Westport Innovations and UPS have partnered to build more than 1,100 natural gas trucks for the UPS (NYSE: UPS) fleet. WPRT is also working on development plans with General Motors (NYSE: GM / TSX: GMM) to develop new natural gas engine technologies and Caterpillar (NYSE: CAT) to co-develop engines for off-road equipment. World CNG plans to have well over 200 natural gas taxis in Chicago by the second quarter of 2012.

The United States has a lot of natural gas, it’s cleaner than oil and it will help our country get off of foreign oil. Even Obama is on the NGV train, proposing a tax-credit to encourage car owners to convert their vehicles from gasoline to natural gas (WPRT, World One and CLNE’s BAF Technologies all do after-market natural gas engine conversions). Visit the DOE for information on converting your vehicle to natural gas or any other alternative fuel.