Today I’m going to discuss why the price-to-earnings (P/E) multiple is not the best multiple to look at when evaluating oil and gas stocks. While the P/E multiple is widely-used and straightforward, earnings tend to be variable and are subject to manipulation through the recognition of large one-time losses/gains, etc. Because of the variability of earnings, the price-to-operating cash flow per share (P/CFPS) multiple is preferred to the P/E multiple when evaluating oil and gas stocks. To show you why this is so, let’s take a look at an example:

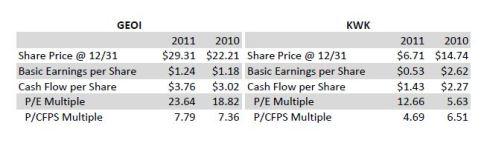

In the table below, I’ll compare the P/E and P/CFPS multiples of Quicksilver Resources (NYSE: KWK), a small-cap gas-weighted operator whose assets stretch from the Barnett Shale in Texas to the Horn River Basin in Northern British Columbia, to GeoResources (NASDAQ: GEOI), a small-cap oil-weighted operator with assets primarily in the Eagle Ford Shale of South Texas and the Bakken Shale of Western North Dakota.

KWK’s stock looks less expensive than GEOI’s when looking at its P/E multiple in 2010. In 2011, KWK’s P/E multiple increased 125% versus only 26% for GEOI, making KWK’s stock appear less attractive than it was in 2010. If you were to only look at the P/E multiple, you might conclude that KWK is now more expensive than it was in 2010, however this may not be true. KWK’s stock looks cheaper than GEOI’s when comparing P/CFPS multiples in 2010 and like even more of a value buy in 2011. The mixed signals KWK’s P/E and P/CFPS multiples are sending can (in part) be explained by impairment expense (see definition below).

Earnings tend to have high variability in the oil and gas industry due to impairment expense, a one-time non-cash expense that can have a significant impact on earnings. When oil and gas assets are acquired they are capitalized at cost and expensed thereafter. If the assets are deemed impaired due to a decline in commodity prices or a revision of proved reserves, an impairment expense is incurred.

In 2011, KWK incurred an impairment expense (due in part to low natural gas prices) of $107 million versus $48 million in 2010. By contrast, (keep in mind KWK and GEOI are similar sized companies) GEOI incurred an impairment expense of only $3 million and $6 million in 2010 and 2011, respectively. KWK’s impairment expense contributed to the company’s earnings per share total in 2011 which decreased 80% from 2010, leading to a 125% increase in its P/E multiple. Over this same time period, KWK’s cash flow per share decreased by 37% and its P/CFPS multiple actually decreased due to the stock price decline KWK incurred during 2011. KWK’s relatively lower cash flow decline versus earnings kept the P/CFPS multiple more stable than the P/E earnings, providing a more accurate view of the company’s performance during 2011.

Keep in mind that the purpose of this post isn’t to determine to what extent KWK is undervalued with respect to GEOI, it’s to show the impact that impairment expense can have on the P/E ratio, thus rendering the ratio less valuable when evaluating oil and gas stocks. Remember, cash is king in the finance world, and while high impairment expense can signal trouble for a company down the road, it doesn’t impact the cash flow statement.

Glossary of Terms

Gas-Weighted/Oil-Weighted: Proved reserves predominantly consist of gas/oil.

Proved Reserves: Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations (Source: SEC). Proved reserves are often referred to as 1p or P90 which indicates a 90% probability of extraction of estimated reserve total.

Impairment Expense: A non-cash expense incurred when it is determined that the carrying value of a company’s oil and gas assets is greater than the actual value of the assets. Impairment can occur due to a reserves revision, a decrease in oil and gas prices, etc.